Financing the Future of the Forgotten

Human creativity and human capacity is limitless. In its presence, all the problems of the world cannot stand for even a few seconds. They must fall.

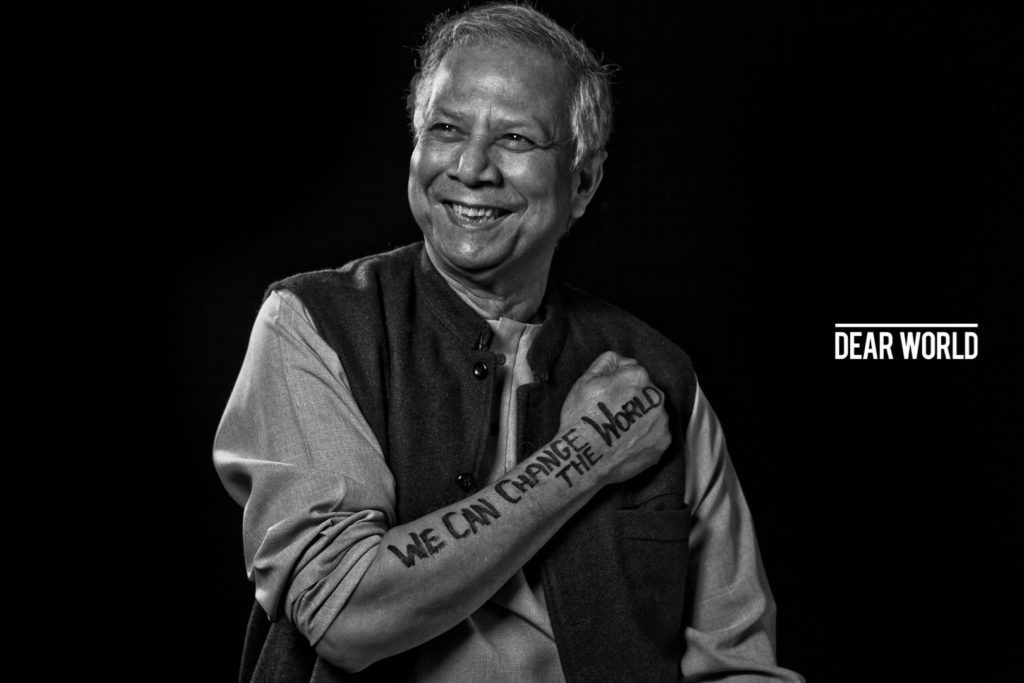

— Muhammad Yunus

For so long, finance invoked an image of rich white men thinking of ways to get richer. They called themselves entrepreneurs and made it seem like it was an exclusive club, reserved for those with the access, resources and the subsequent confidence to work for themselves. The path to build ownership and financial security in our system isn’t as simple as A to B, hard work to rewards. To start a business for yourself, many people may think the first step is the idea itself, a supply to some demand you’ve deduced from observing your world. Actually, the first step is the belief in yourself to be capable of such an endeavor; to have faith that you can manage this independence and succeed with this mindset. There are institutions that have systematically erased this confidence in women, especially impoverished women of color.

The first step is confidence, the second step is the idea, the third step, then, is capital. Money. Most businesses begin with a loan, a line of credit that allows for the purchase of materials or supplies that will eventually be sold for a profit so the loan can be paid back in small amounts. Credit seems like it should be readily available to the poor so they can find a sustainable way out of their situation, right? Think again. Lines of credit are hard to come by and banks absolutely do not like the idea of giving them out to the poor for their entrepreneurial dreams for fear they will not be paid back. They demand a good credit history, collateral to put up if borrowers can’t pay it back, cash flow, and income, all of which an impoverished woman in a rural, remote village in a third world country would not even understand, let alone have. In these societies, the traditional ideas of creating businesses to maximize profit just does not withstand nor does it make sense. Why would a bank lend money to a beggar when our capitalist system forces us to behave as though maximizing profit is the only goal of having an “entrepreneurial” spirit? This man or woman will not pay the high-interest rates that allow banks to profit off of their loans. The business they create will not be one that is meant to create unimaginable wealth, but rather, it will slightly alleviate the unimaginable suffering of poverty.

Enter Muhammad Yunus.

A 2006 Nobel laureate who redefined this entrepreneurial spirit. In his words, “All human beings are entrepreneurs.” A radical statement because of the two-pronged premise it solidly rests on. First and foremost, poverty is not the fault of the poor people but the systems we create and the concepts we imposed. It is not internally developed and can be overcome. Second, entrepreneurship is not synonymous with a selfish drive for profit, it is synonymous with the human spirit. We are more than just our desire for wealth; we are creative, loving, empathetic and selfless at our core. He pioneered the idea of microfinance loans, a business designed to do good without the expectation of any personal benefit. Microfinance loans are small loans given to these financially marginalized groups of people so they can start businesses and work towards financial freedom even though the borrower has no collateral, something pledged as security in case the loan is defaulted. “In fact, women are major microfinance borrowers, making up 84 percent of loans in 2016, according to the 2017 Microfinance Barometer. Most of these women – around 60 percent – live in rural areas.”

As feminists, we understand the strength in solidarity and denying a group of women access to this independence has no place in our movement. Muhammad Yunus set out with this idea when he founded the microcredit lender, Grameen Bank, in Bangladesh, specifically for poor women. There are no interests and with a payback rate of 95% from the 8.3 million borrowers, 97% of whom are women, Yunus proves the life-changing impact of this program. “Right now we have over 18,000 students in medical schools, engineering schools, universities, with Grameen bank loans. So you are creating a completely new generation. And our idea is, of this 7.2 million families that we have, at least these children will not go back to the same level that their parents were—who lived in the cycle of poverty.”

Shift from profit to impact

The shift from profit to impact is key. It helps define our priority at EBY. 10% of the proceeds of every EBY purchase goes to fund microfinance loans distributed by a host of microfinance non-profits, including Opportunity International.

The incredible thing about microfinance loans is that one loan turns into many loans. When the loans are paid off (which by the way have a 98% repayment rate!), the money is re-loaned to a new recipient.

Via EBY’s microfinance efforts, in 2019 alone, 685 microloans were given to women in Colombia, Nicaragua, and Haiti, with a total number of 1,774 people impacted.

When an earthquake devastated Haiti, a microfinance loan fueled by EBY sales, helped Odette start a drugstore in her small remote village so people did not have to walk miles for pain relief. Domestic violence is a systemic issue Nicaraguan women face and with aid of these loans, they are able to foster this confidence to leave unlivable circumstances, provide education for their children, and a livelihood for themselves, breaking a generational cycle of abuse and poverty.

Our contribution of $20,000 will fund 130 women in rural India, the invisible lifeline of the Agrarian economy, as well as their family members, a total of 380 lives changed.

When impact is a force of business, the power is not monetary. It becomes unquantifiable because it is abstract and infinite. When our founder, Renata Black, traveled to Grameen Bank and took Yunus’s teachings back to India, carrying the books to make 800 women creditworthy, it was a time that offered clarity of purpose for her and her eventual role at EBY. Microfinance loans don’t just grant these women financial independence, but a way to channel the work ethic and creativity they already have into a life they couldn’t even have imagined. We are all entrepreneurs. We are all worthy of confidence, faith, and ambition.

We know what’s underneath matters to you. At our core, we are a women’s empowerment company that stands for strong values and principles. Ten percent of every order of our comfortable, body-celebrating seamless underwear, bralettes, shapewear, and masks fund Microfinance loans for female entrepreneurs around the world. That’s also why all seamless products on our site are made at manufacturing plants under the Women’s Empowerment Principles developed by the United Nations. That means your panties are made ethically: no sweatshops, and no fast fashion. Learn more about our mission and our products.